Article content

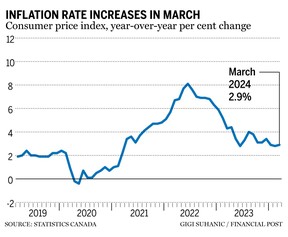

Analysts had expected inflation to rise between 2.9 and 3 per cent.

Article content

“We’re almost there, with just one more step to go,” Canadian Chamber of Commerce senior economist Andrew DiCapua said in response to the data release.

The Bank of Canada’s preferred core measures, CPI trim and median, both eased and averaged below the top end of the 1 per cent to 3 per cent inflation target for the first time since the summer of 2021, said Royal Bank of Canada economist Claire Fan.

“March’s reading today confirmed that broad-based easing in price pressures in Canada are indeed underway,” Fan said, adding that she continues to look for slowing inflation to allow for a first rate cut from the Bank of Canada in June.

Bank of Montreal chief economist Douglas Porter said the data will likely keep the central bank on track for a June cut, but there is still another CPI report, the Federal Budget and a reading on gross domestic product to come before the next meeting.

Statistics Canada said gasoline prices mainly drove the acceleration in headline inflation, as prices at the pump rose faster in March than in February.

Recommended from Editorial

-

Inflation unlikely to change Bank of Canada’s direction

-

Oil prices could breach $100 as Middle East conflict worsens

-

Canada’s productivity woes going from bad to worse

On a monthly basis, the CPI rose 0.6 per cent in March.

• Email: dpaglinawan@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Share this article in your social network

Source link